3. Bonds, Money and Credit Markets

Time again to increase duration risks

Dr. David-Michael Lincke, Head of Portfolio Management

In brief

- The bond markets paint a gloomy picture of the economic outlook for the global economy. Not only have interest rates fallen dramatically worldwide at the long end, the inversion of the US yield curve also signals the danger of a recession.

- The global market value of negative interest-bearing bonds has reached a new record high.

- Against this backdrop, investors are advised to raise duration risks in the portfolio again.

- High economic sensitivity and the gradual deterioration in the quality of the investment universe have caused us to keep our distance from corporate bonds, while emerging market bonds are on the upswing again, attracting significantly higher yields than government bonds from the OECD region.

Outlook

Although quotations for government bonds have already risen dramatically since the beginning of the year and have massively increased the proportion of negative interest-bearing bonds (particularly in Europe), the price of government bonds has risen sharply since the beginning of the year. Should the anticipated slowdown in the global economy continue, however, there is still considerable further price potential, especially for US government bonds. We therefore recommend investors to increase the duration risks in the portfolio and to reduce money market exposures and variable-rate investments in view of the coming cuts in key interest rates. In particular, emerging market bonds offer opportunities to optimise portfolio returns, not only attracting higher declines in yields but also promising additional potential in view of significantly undervalued currencies. By contrast, we remain reluctant to issue corporate bonds, despite an encouraging performance so far this year. The quality of the asset class has continued to deteriorate and cyclical vulnerability has increased.

Comment

The bond markets paint a gloomy picture of the economic outlook for the global economy

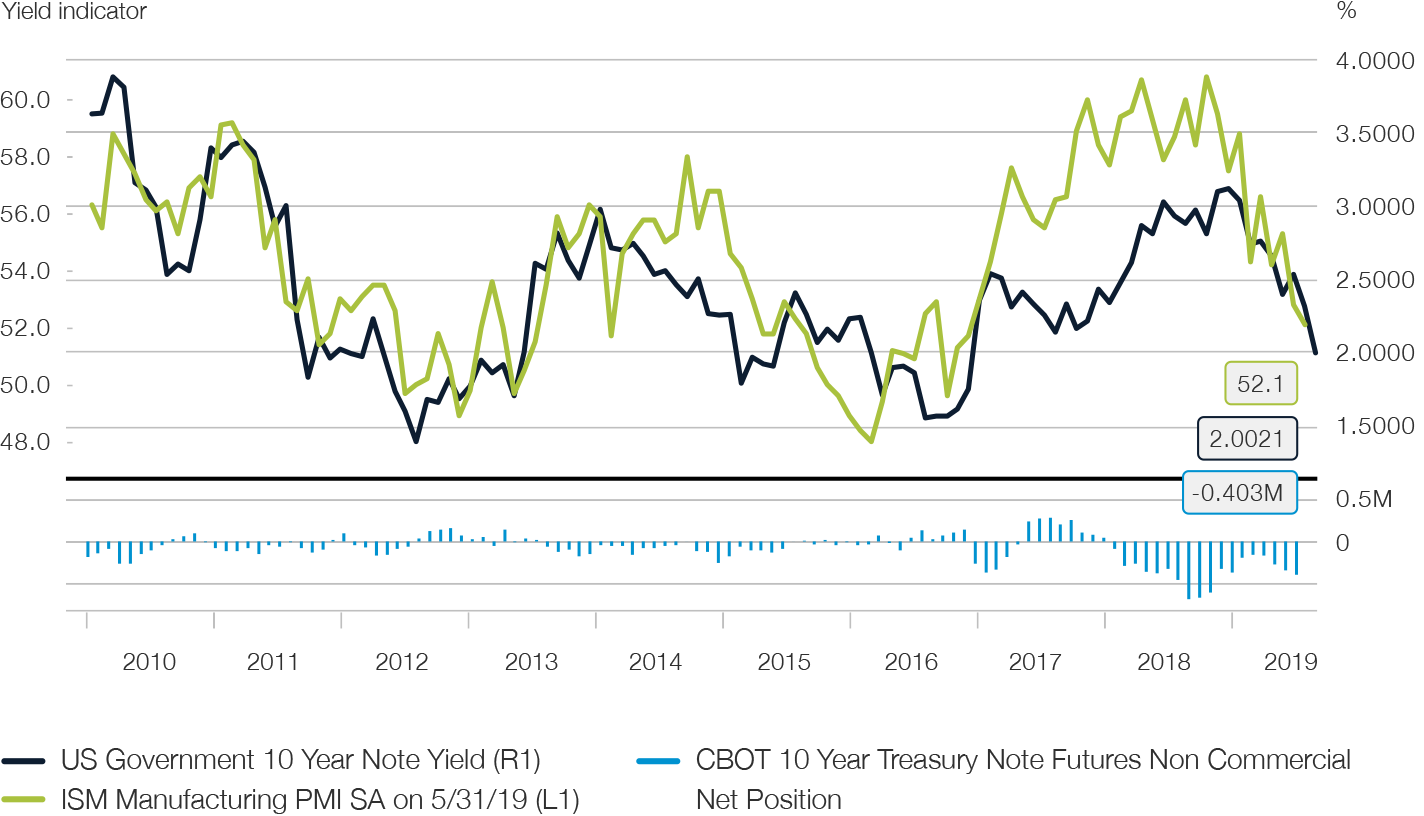

The much-cited turnaround in interest rates, which ten-year US government bonds at times saw flirting with yields of more than 3%, proved to be a short interlude. Since the beginning of the year, yields on long-dated bonds have travelled in only one direction, namely south. With the decline in leading indicators such as the ISM Manufacturing PMI, the expectations gap has also closed, and the signs point in unison to a slowdown in growth (see Fig. 16).

Fig. 16

US government bonds signal economic pessimism, which is now being confirmed by leading economic indicators

It is also fitting that the compression of inflation premiums continued after a brief recovery in the first quarter, which was primarily due to rising energy prices. In both Europe and the United States, inflation expectations have fallen to new lows and are now well below current spot inflation (see also chapter "Macroeconomic Trends").

Nevertheless, the positioning data of the futures exchanges indicate that, in view of the recent rise in net short positions, a good portion of investors have not yet come to terms with the economic implications of falling interest rates at the long end (see Fig. 16).

However, factors that could drive interest are increasingly weakening. The gradual dismantling of the inflated US central bank balance sheet, which throws an additional USD 50 bn in bonds onto the market every month, will come to an end from September. What remains is the massive increase in the financing requirements of US Treasury. Last year's tax reform has left deep holes in the treasury and the budget deficit threatens to break through the trillion mark this year.

The situation in Europe is even more dramatic. The yields on German government bonds have fallen to an all-time low of -0.32%. In Switzerland, even thirty-year-old Confederation bonds no longer have any positive earnings expectations. Even a problem child like Italy, which is in a bitter conflict with the EU Commission over compliance with budget deficit limits, is enjoying falling interest rates at the long end (see Fig. 17). The market pressure on Italy has thus receded. As already postulated in our Outlook for the year, this development underscores the fact that a sustainable solution to the problem of over-indebtedness is not only far from being found in Italy, but an escalation into an acute crisis, which will once again focus on convertibility risks and the continued existence of the Euro, is also just as unlikely in the near future.

Fig. 17

New lows for the yield to maturity on German government bonds, while interest rates in Italy have also fallen significantly despite the budget crisis

This means that interest-rate dampening structural factors have regained the upper hand at the long end of the yield curves, as long-term real interest rates are closely linked to the potential growth of an economy. Given the steady decline in potential growth for developed economies over the past decade, it is likely that the real interest equilibrium rates will remain close to their current low levels, even if a recession is avoided. The structural factors that contributed to this include the accelerated demographic change, the high indebtedness of both public and private budgets and the resulting lack of propensity to consume and invest.

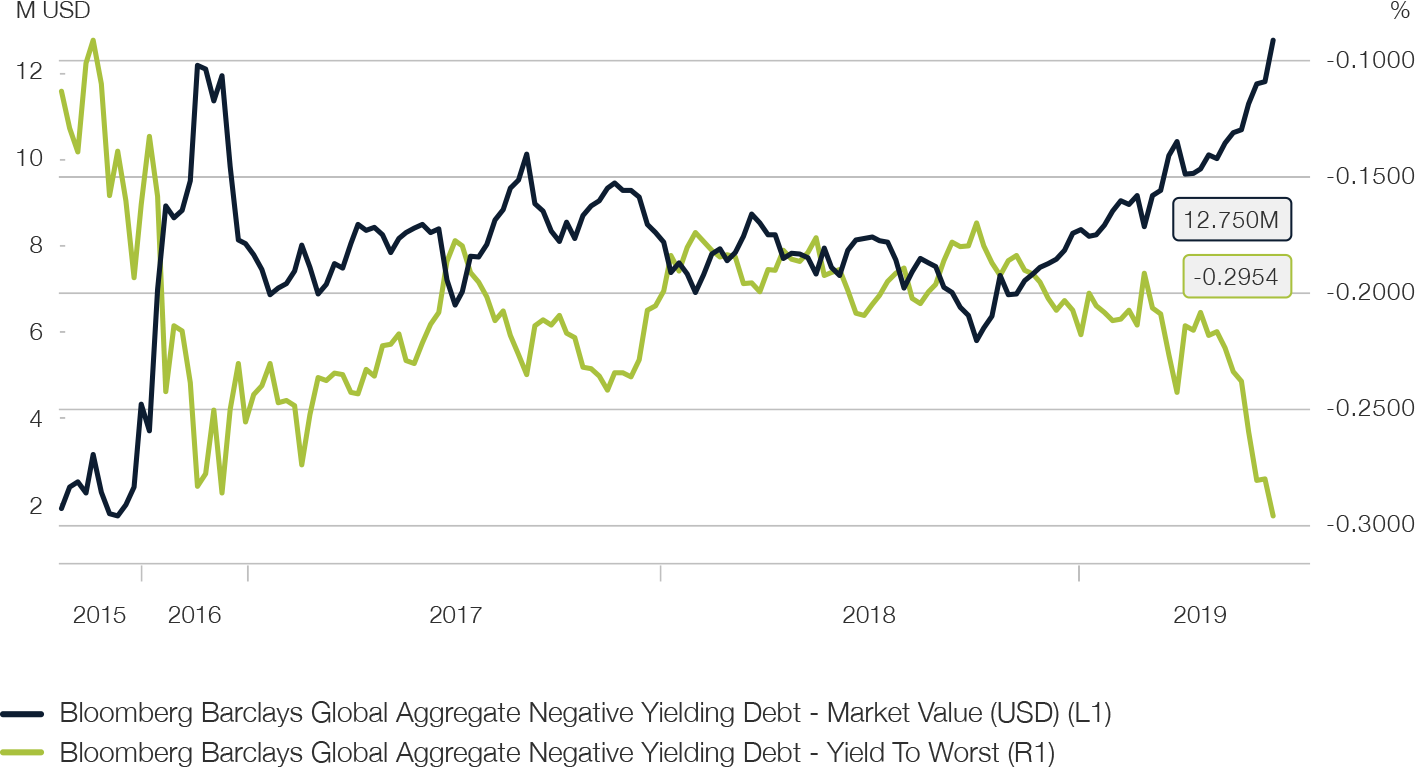

The dramatic nature of this development becomes particularly clear when one considers the development of the outstanding market value of bonds with negative yields to maturity (see Fig. 18). This has risen sharply since the beginning of the year and has reached a level of almost USD 13 bn, exceeding the peak of 2016. The weighted yield to maturity on these liabilities has also fallen to a new record low of -0.3%. This means that half of all outstanding European government bonds and 20% of the universe of European corporate bonds with investment grade ratings are now producing negative yields. The "Japanification" of the rest of the world is in full swing.

Fig. 18

Global market value of negative interest-bearing bonds has risen to a new record high

Even more clearly than when using basis of falling declining yields alone, signals of scepticism regarding the longevity of economic expansion are revealed in an analysis of yield curves. These have flattened further for US Treasuries in the course of the year to date. Segments that cover more than 60% of the treasury curve have even inverted, including the noteworthy segment between three months and ten years (see Fig. 19). In the past, the inversion of the yield curve has proven to be a reliable harbinger of an economic downturn and has preceded the last seven US recessions. However, its use as a timing signal is limited. In the past, the period up to the actual onset of a recession has lasted from a few months to more than two years.

In order to benefit as an investor from this development, it makes sense to bet on a continuation of the yield curve's inversion trend, for example, by means of flattener structures on the segment between two and ten years.

Fig. 19

The inversion of the yield curve has proven to be an indicator of an imminent recession in the United States in the past.

Investors are advised to increase duration risks in their portfolios again

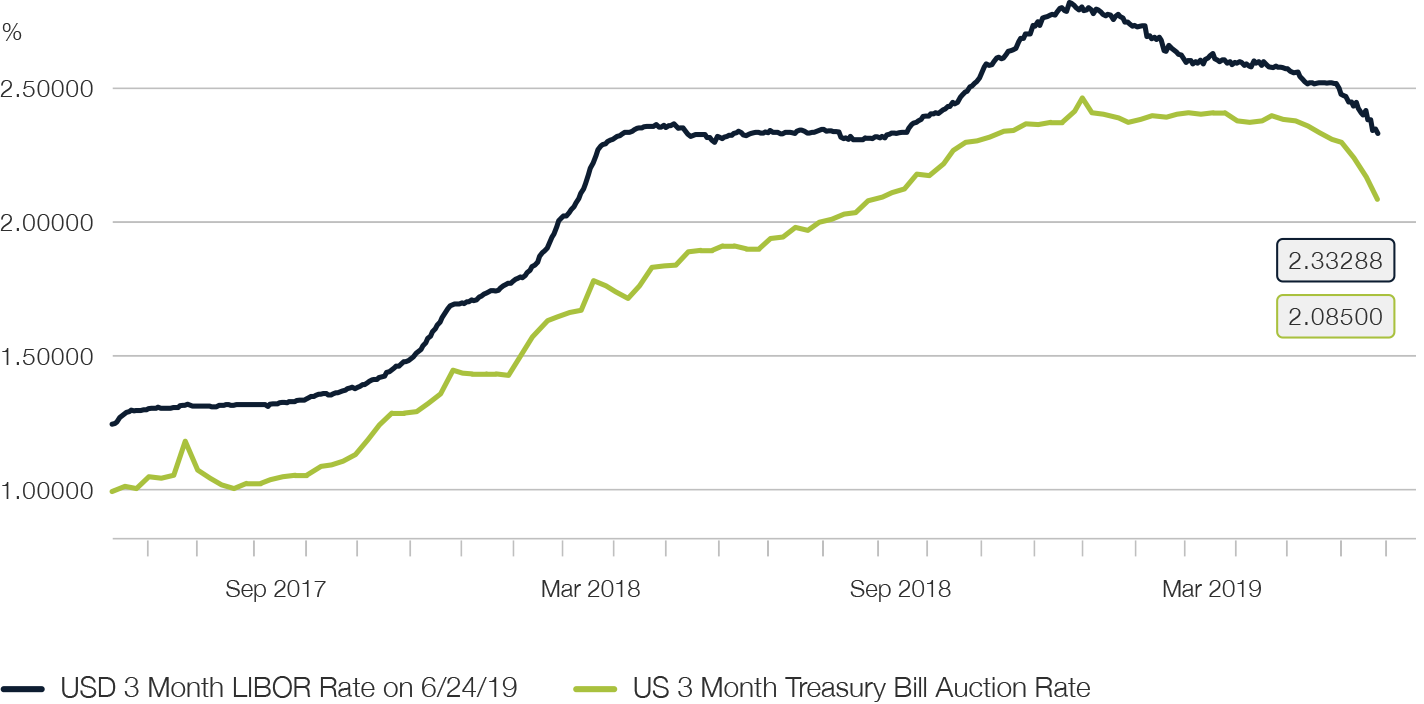

While variable-rate exposures on a USD basis in floating rate notes or in the US money market were still the first choice at the beginning of the year in view of a tightening monetary policy, the picture changed dramatically with the turnaround in US central bank policy.

The money market has already responded to expectations of up to three rate cuts in the second half of the year. The yield on three-month US Treasury Bills is already 25 basis points below the lower threshold of the current key interest rate corridor of 2.25% to 2.50%. US dollar LIBOR shows a comparable trend.

In the rest of the world, too, efforts to normalise monetary policy have come to an end before they were even seriously attempted. The ECB has already announced further interest rate cuts and even the resumption of bond purchases.

Investors are therefore advised to increase the duration risks in their portfolios again and to give more weight to fixed-interest bonds with a long maturity. Should scenario of a recession materialise, there is then potential for a significant further fall in declining yields, especially on US bonds.

Fig. 20

The US dollar money market has already responded to the expectation of falling key interest rates

Emerging market bonds on the rise again

In terms of yields, bonds issued by emerging countries are much more attractive than government bonds from the OECD region. This is because there are still declining yields of over 5% in both local currency and hard currency.

Factors that put emerging market bond markets under significant selling pressure last year have largely dissipated. This means that, against the backdrop of constantly rising interest rates in the United States and the associated appreciation pressure on the US dollar, the devaluation pressure on the EM-FX complex has come to an end. Incentives for capital flight and the resulting compulsion to pursue a restrictive monetary policy have diminished. However, the threat of a further escalation of the trade war is still a risk for the export-dependent emerging market economies.

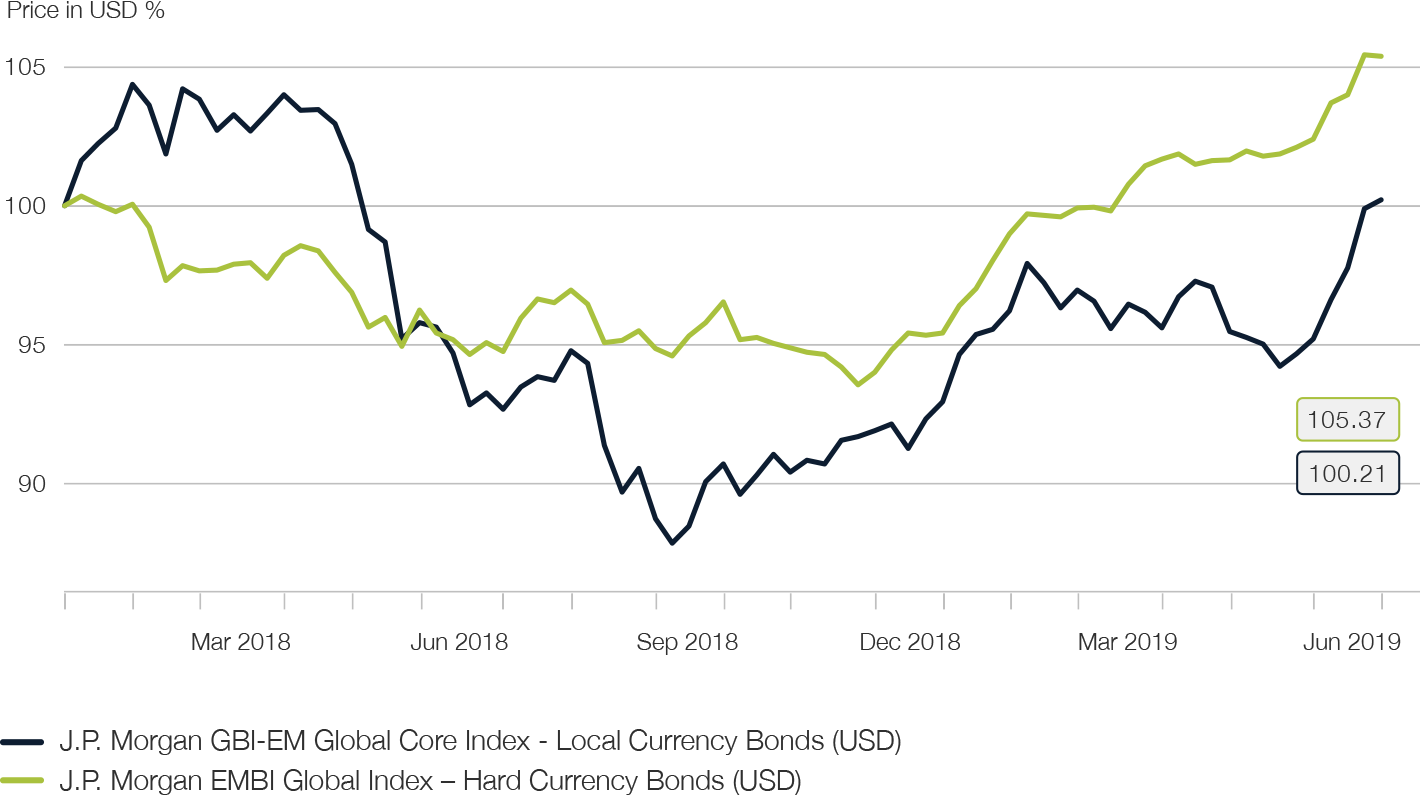

As a result, emerging market bonds have already performed well in the first half of the year. According to the JP Morgan GBI-EM Diversified Index, they gained more than 8% in local currency terms in USD and even delivered 10% returns in hard currency terms on the basis of the JP Morgen EMBI Global Index (see Fig. 21).

In our Outlook, emerging market bonds in local currency appear particularly promising. Despite the recent recovery, emerging market currencies continue to trade well below their true value against the US dollar. They should continue to appreciate in the coming months thanks to favourable economic conditions. Economic growth in the emerging markets continues to be better than in the industrialised countries. The gap between the leading indicators of the emerging and industrialised countries remains wide.

However, hard-currency emerging market bonds are also still attractive, as the relative economic strength of emerging markets helps to narrow the yield spreads between these bonds and US government bonds.

According to the Institute of International Finance, emerging market bonds recorded inflows of USD 24 bn in April for the eighth consecutive month.

Fig. 21

The outlook for emerging market bonds has brightened significantly

Credit markets: Latent but tame source of systemic risk, even in the short term

In the corporate bond markets, the turnaround in monetary policy – from tightening, to the sudden possibility of interest rate cuts – has pushed the risks of weaker growth into the shadows. As a result, the yield spreads between riskier bonds and relatively safe bond instruments have narrowed. Interest premiums for US investment grade bonds and US high-yield bonds against US government bonds have fallen steadily since the beginning of the year and only recently picked up again moderately in the wake of the trade talks' collapse. Spreads are thus well below the level they had reached in 2015/16, in an environment of similar uncertainty regarding the outlook for the global economy (see Fig. 22).

Nevertheless, it is becoming increasingly clear that the credit markets are probably the weakest link in the chain of global risk sources. There are a number of reasons for this:

Fig. 22

Credit spreads in investment grade and high yield sectors have shrunk since the beginning of the year

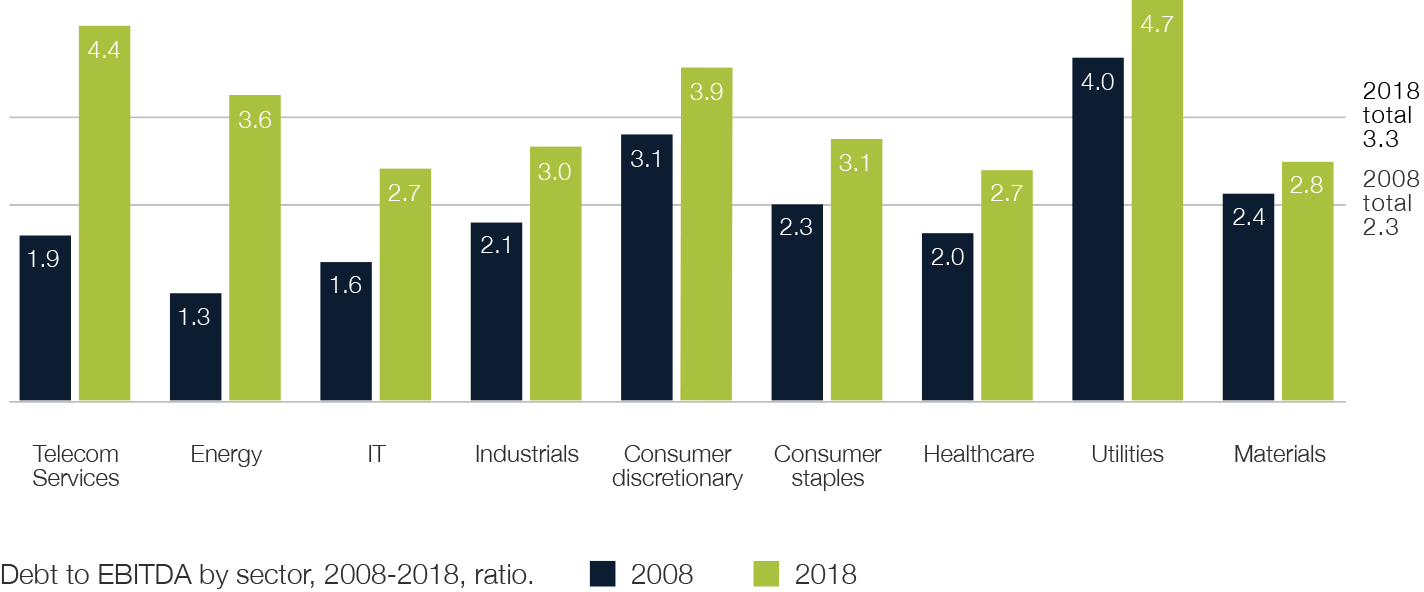

The era of cheap money and unlimited liquidity over the past decade, combined with a subdued economic environment that offered only limited organic growth opportunities, has given companies incentives to leverage their balance sheets to an unprecedented extent. The ratio of net corporate debt to earnings power (EBITDA) across all sectors is significantly and in some cases even dramatically higher than in 2008 when the global financial crisis broke out (see Fig. 23).

In the weaker economic environment that is becoming apparent, there is a particular threat of a slowdown in sales growth, falling profits and pressure on profit margins. This will make the serviceability of these liabilities more difficult and will result in tightening credit spreads and, indirectly, rising default rates.

Fig. 23

Corporate debt ratio by sector in 2008 vs. 2018

From an investor's perspective, the fact that the quality of the investment universe as a whole has gradually deteriorated over the past few years is also cause for concern. A study by Morgan Stanley concludes that if only the degree of indebtedness of companies were used as a criterion, 45% of all corporate bonds rated as investment grade would instead have to be classified as junk. In 2017, this share was only 30%; in 2011 it was only 8% of the universe. The proportion of low-quality bonds with a BBB rating has also risen massively over the last decade and, with more than 50% of the investment grade universe, is now higher than the sum of all bonds in the AAA-A rating band. In the event of an economic downturn, BBB bonds are particularly susceptible to downgrades, and generally suffer from particularly pronounced price losses in this case due to their falling out of the investment-grade universe.

The outlook for Europe is particularly bleak. Valuations on the European credit markets have improved over the past year. However, with the discontinuation of the ECB's CSPP corporate bond purchase programme, which has been an essential source of demand over the past two and a half years, buyers at the current spread level are likely to remain scarce. The high-yield sector in particular is suffering from the easing of the investment crisis. In addition, investment funds have already experienced strong outflows of between 7% and 8% of their funds in the past year – a trend that is likely to continue. Corporate bonds have an inherently asymmetrical yield profile to the detriment of investors, i.e. they are characterised by a higher downward than upward potential. This is all the more true at the end of this cycle, as the current historically low yields mean that investors will have to forgo many years of coupon income when a company is downgraded or financially restructured. For these reasons, we recommend that investors exercise restraint with regard to corporate bond exposures, particularly with regard to high-yield bonds and BBB bonds.

Share Insight

Important notice

Note that telephone calls on our lines are recorded. By calling us we assume that you agree to your call being recorded. The Swiss Bankers Association’s ‘‘Directives on the Independence of Financial Research do not apply to this presentation. We wish to point out that Picard Angst Ltd. may have interests of its own in the price performance of one or more of the securities described in this document. This document does not constitute an offer or invitation to buy or sell securities. It is intended for information only. All opinions are subject to alteration without prior notification. The opinions expressed here may differ to opinions expressed in other documents published by Picard Angst Ltd. including research publications. Neither the document as a whole nor individual parts of it may be reused or distributed to other parties. Although Picard Angst Ltd. is of the opinion that the information contained in this document is based on reliable sources, Picard Angst Ltd. can accept no liability for the quality, accuracy, current relevance or completeness of this information.

© Picard Angst Ltd.

Regulated by the Swiss Financial Market Supervisory Authority (FINMA).