5. India

Investments and consumption will bring growth back on track

Chrys Kamber, Fund Manager – Head of Indian Investments

In Short

- General election: Mr. Modi has returned as PM of India with a historic mandate

- US government has withdrawn the exemption granted to eight countries including India for oil imports from Iran

- Termination of GSP program between US and India

- Three rate cuts: 75 bps cut within the first six months of 2019

- NBFC defaults and credit slump

- Slowdown in real GDP growth

Outlook

- Stable government and continuity of economic reforms

- India can benefit from US-China trade war

- Another 50 bps cut in interest rate and 25 bps cut in cash reserve ratio expected

- Private capex to start as the capacity utilization have reached the threshold

- Government spending will continue and consumption to recover in 2QFY20

- Performance gap between the large cap and mid & small cap and the stark valuation divergence should narrow

- Global indices are trading at high valuations, undervalued Indian small and mid-cap provide better alternative

Weak first six months

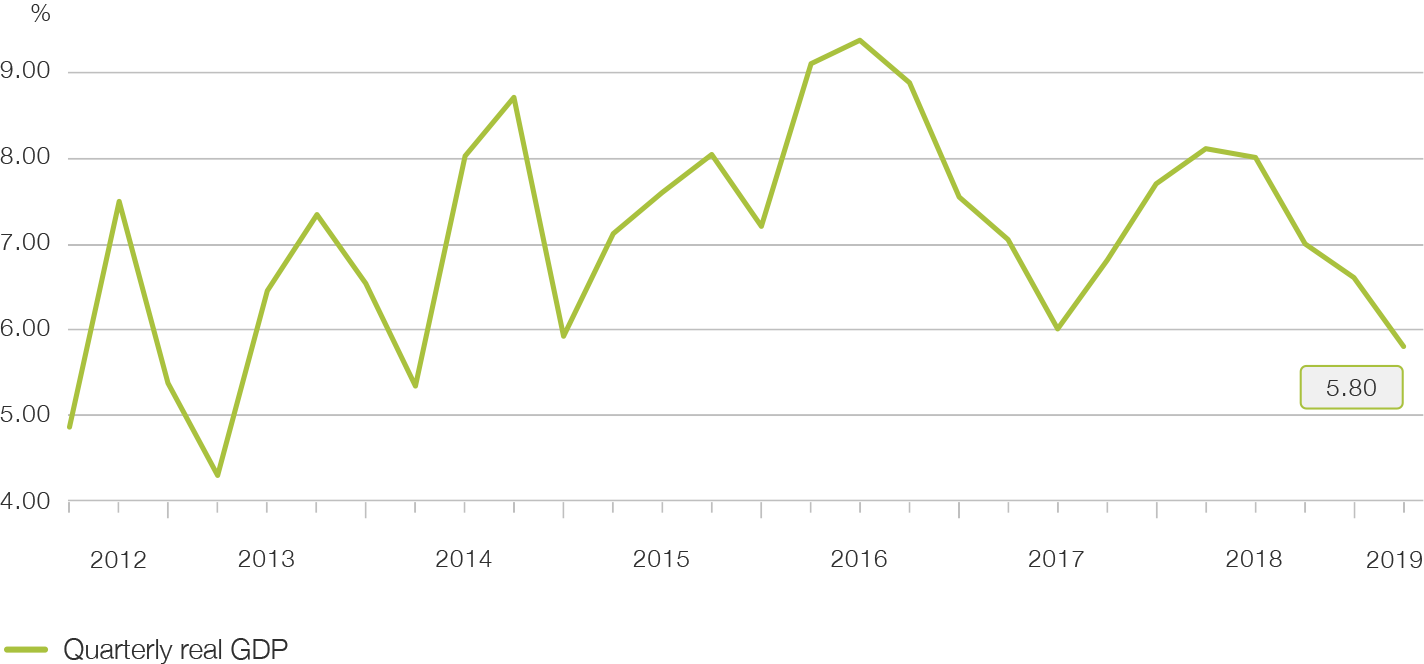

The Indian economic data has not been encouraging for the first half of CY2019. The real GDP growth moderated to 5.8% during the fourth quarter of FY19 (January -March 2019). This was expected, given that it was an election year. However, the real GDP for the full FY2019 (April 2018 - March 2019) still grew by 6.8%.

Fig. 27

Real GDP growth

Heightened global volatility, interest rate hikes in developed economies, general election uncertainty and the valuation differential compared to other EMs shifted the global allocation from India to developed markets at the beginning of the year. Additionally, the geo-political tension between Pakistan and India and the US sanctions on Iran weighed down investor sentiment. The majority of domestic investors adopted a wait and watch mode to the political continuity is in place after the elections. They either held high levels of cash in their portfolios or found refuge in large cap strategies.

A chain of defaults in debt repayment related to promoter groups such as Reliance Communications, Vedanta and Essel Group and NBFCs such as Dewan Housing Finance Corporation, dominated the first half of the 2019. As a consequence, banks have become risk averse and are lending cautiously. Nevertheless, the NBFCs with strong balance sheets and a good track record have been able to raise funds and continued to post strong growth.

India was granted an exception to import crude oil from Iran despite US sanctions being in place. The reversal of the US stance related to such waivers and the termination of the General System of Preferences (GSP) Program by the US government triggered a negative sentiment and, hence, the broader stock market underperformed the large cap Nifty 50 Index. India was a beneficiary of the GSP program since 1974. Although this program was initially significant for India, the quantum of benefit has reduced over the years. The causalities related to the GSP termination is therefore minimal. Abandoning its usual non-confrontational stance, India has decided to retaliate on US imports.

The general slowdown in economic activities during the election year had an impact on the corporate earnings. The Q4FY19 (Jan. - Mar. 2019) earnings growth fell for the first time after posting positive earnings for six consecutive quarters. The companies in the consumer staples, discretionary and auto sectors suffered the most, due to the moderation in the overall demand. The two wheelers category saw a sharp decline due to the fall in aggregate rural demand. Auto and auto ancillary sectors sales slumped amid the tight liquidity environment, a sharp decline in demand of first-time buyers and the increase in insurance costs. The rural distress, liquidity crunch and the general election took a toll on consumption. Interactions with the management of consumer related companies suggest that the earnings will recover from the September quarter onwards.

Mr. Modi's scale of victory in the recently concluded general election put the political uncertainty to rest. On the day after the exit polls had indicated a strong win for the BJP led NDA government, the stock market opened with a gap and the Nifty 50 Index reached an all-time high at closing. Only few stocks were driving the Nifty Index while the rest of the index components and the broader market were passive spectators. The gap between the large cap versus small and mid-cap has widened further.

Undervalued SMEs ideally positioned

The noise around the US-China trade war, global growth slowdown and geo-political tensions will take their own course but in the Indian context, the growth has upward momentum.

Given the strong mandate of the government, there is a general expectation for major reforms such as land acquisition and labour law to support the manufacturing industry. The latest PMI manufacturing data has hit a three months high which in turn suggests the worst is over and growth recovery is around the corner.

The government has set the priority to bring the economy back to a higher trajectory, focusing on investments and tackling the unemployment rate of young Indians in order to restore consumption. The real interest rate in India is still high (+3%) compared to other major economies, which makes Indian businesses less competitive. At present, central banks globally are firmly leaning towards dovish stance. Hence, the RBI would take the same trajectory and reduce the benchmark interest rate. Benign inflation (an average of 3.5% over the last 18 months) and stable crude oil price will persuade the RBI to cut the interest rate by 50bps (25bps cut in August), along with a 25bps cash reserve ratio (CRR) cut in FY20. A nominal GDP target of USD 5 trillion and the government’s initiative to issue USD denominated bonds will further incentivize RBI to prevent depreciation of the rupee. In this context, INR has sufficient room for further appreciation against the US dollar by end of this year. INR 700 bn was allocated to recapitalize the public sector banks, post which the banks will be in better shape to fund higher credit growth. Easing monetary policy and faster lending process should enable the private capex to kick start by the end of this year, as the total capacity utilization has reached 77% (historically, the private capex rebounds when the capacity utilization reaches roughly 75% - 80%). A lower cost of capital and GDP growth recovery will aid the broader equity market.

While India needs to address the domestic challenges, it sees a window of opportunity in the US-China trade war. Many US companies are diversifying their China dependent portfolio and looking for relocation. India can provide the basic ingredients to attract these businesses such as a skilled labour force at low cost and tax incentives. The country has improved the ease of doing business in the last five years, and combined with a stable government and common law based judicial system provides additional support for this case. We are seeing a similar trend developing in the Indian chemical industry since a couple of years, initiated by stringent Chinese anti-pollution norms and security compliance, which are already in place in India. The technology and industrials sectors will be the next major beneficiaries. This influx will create employment, boost exports and accelerate the economic growth.

During its first mandate, the Modi government, through different schemes, built 218’000 km of roads (triple the size of the total road network of Switzerland), established 112 million LPG connections, built 15.5 million affordable housing, 92 million toilets and has provided 40 million households with electricity in rural India. These schemes had secured the rural votes despite the hardship caused by the demonetisation and the GST implementation. Furthermore, in the FY20 post-election budget, the government has increased the allocation to the agriculture sector and to the farmers’ welfare schemes by 92.5% in order to double the farmers’ income in the next five years. The direct benefit transfer (DBT) system will ensure that these benefits will reach the farmers directly without any leakages. The improvement in rural infrastructure and rural schemes should boost the rural economy and support the recovery of the rural consumption by the end of this year, which is in line with the narrative of the management of consumer sector companies.

The FY20 post-election budget has paved the way towards a reduction of the fiscal deficit to 3.3% (instead of 3.4%), while taking measures to facilitate foreign capital inflows. Disinvestments in some of the public sector undertaking to the amount of INR 1 trillion is in the FY20 agenda of the government, which should accommodate the government spending in infrastructure. Other key announcements of the budget were a 14% increase related to the infrastructure spending. Public spending, which took a back seat during the election, will now be resuscitated. Paused infrastructure projects will get a fresh start and new infrastructure projects will be rapidly approved. Companies in building material, construction and equipment manufacturing should benefit.

A stable government ensuring continuity of policy reforms has encouraged the foreign investors. International sovereign wealth funds are investing in Indian infrastructure from renewable energy to airports. Private equity deals have surged, in 2018 roughly USD 19 billion was invested in private equity deals, the highest in the last ten years. This trend will continue and India will be among the top countries receiving FDI inflows.

The current macro factors are supportive of an earnings revival: low inflation, falling crude oil prices, easing monetary policy and a narrowing current account deficit. Moreover, our interactions with the managements of consumer credit companies suggests that a full revival in consumption is expected in the 3QFY20 (October - December 2019). The FY20 budget has reduced the corporate tax to 25% for companies generating revenues up to INR 4 billion, which is another booster for smaller enterprises.

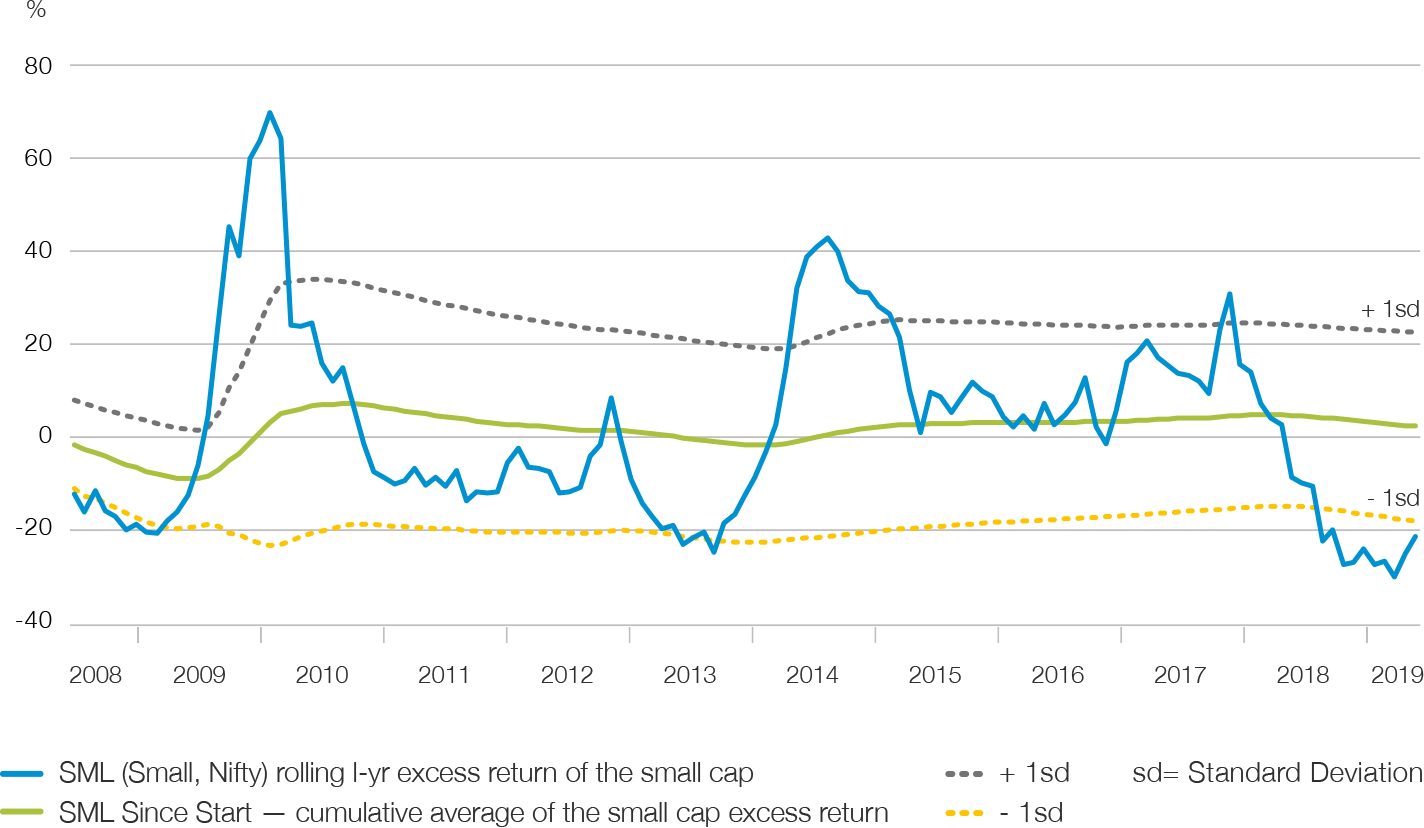

Finally, the performance gap between the large cap and mid & small cap and the stark valuation divergence should narrow. The Nifty 50 Index is trading at two standard deviation above the mean and the small cap index is around one standard deviation below the mean. The performance of the Nifty 50 Index since 2018, was driven only by top ten companies. The top weighted companies generated a performance of 30% while the rest of the Nifty 50 companies posted a negative return of 13%. In combination of rate cuts, moderation in cost of capital and GDP growth recovery will support the earnings growth. Small and mid-sized companies with healthy balance sheets, stronger earnings outlook and gaining market share in domestic consumer related businesses will outperform by the end of this year. However, a broad-based earnings recovery might take another two quarters until the monetary policy and other growth supportive measure are fully transferred into the system. As the valuations are all time high globally, Indian small and mid-cap are in the sweet spot in valuation perspective.

Fig. 28

Small-cap positive cycle is imminent

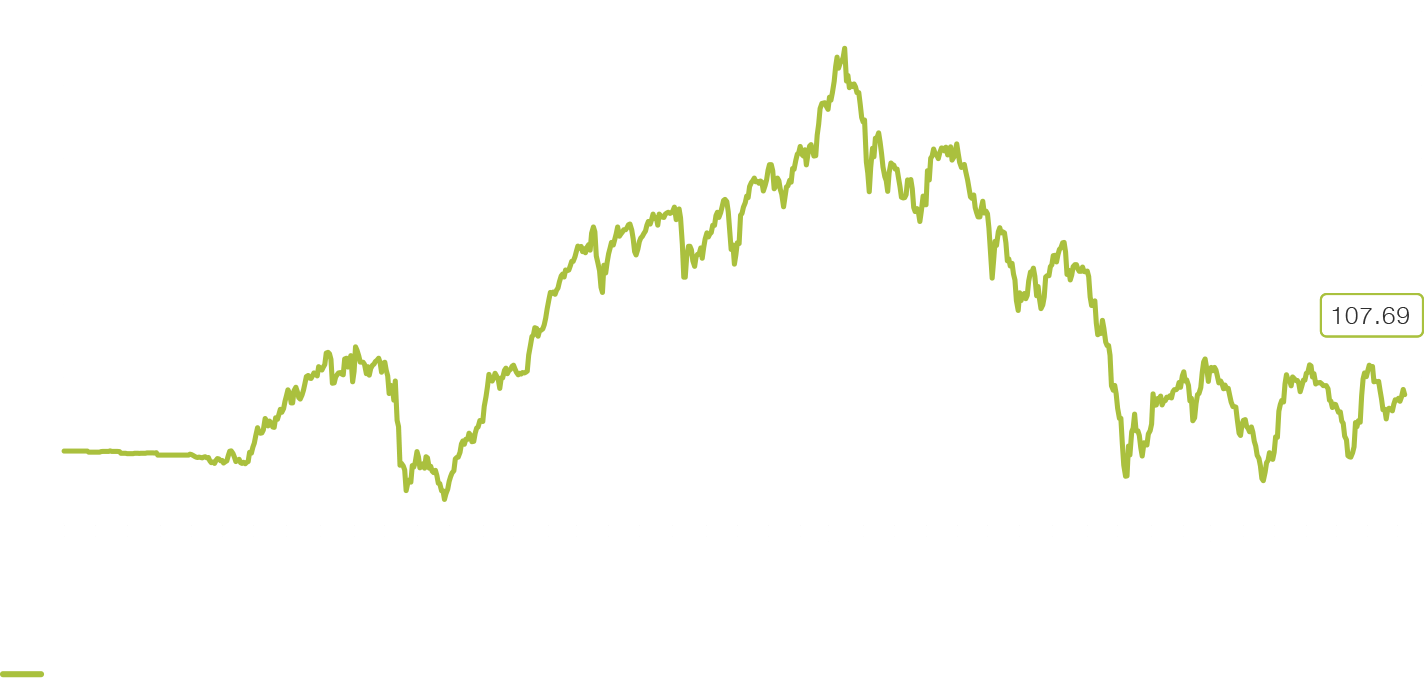

Padma India Fund

Picard Angst's Padma India Fund focuses on investing in small and medium sized companies operating in fast-growing industries and trades. This allows investors to benefit from the rapid structural change in the Indian economy.

Performance Picard Angst PPFII Padma India Fund I USD

Factsheets and other documents can be found at picardangst.ch/downloads or directly with your contact person.

India Real Estate Fund

Picard Angst's India Real Estate Fund focuses on the financing of residential real estate in prime locations in the Indian metropolis of Mumbai. The demand for such property is immense. When selecting projects, the India Real Estate Fund benefits from the profound market expertise of the Steiner Group. The developer, total and general contractor of real estate has already completed more than 1,500 residential and 845 commercial properties in Switzerland and India. The Steiner Group has been part of the Hindustan Construction Company Ltd. since 2010. (HCC) based in Mumbai, India.

Master data

- $ 43 MIO NAV

- IRR >15%

- 3 Ongoing projects

| Investment group | Qualified investors in Switzerland |

| Currency | USD (USD/INR hedging) |

| AIFM & Portfolio Manager | MDO Management Company, Luxembourg |

| Legal form | SICAV |

| Fund structure | Reserved Alternative Investment Fund (RAIF) – closed-end fund |

| Seat | Luxembourg |

| Term | Up to 5 years (2 years extension possible) |

Share Insight

Important notice

Note that telephone calls on our lines are recorded. By calling us we assume that you agree to your call being recorded. The Swiss Bankers Association’s ‘‘Directives on the Independence of Financial Research do not apply to this presentation. We wish to point out that Picard Angst Ltd. may have interests of its own in the price performance of one or more of the securities described in this document. This document does not constitute an offer or invitation to buy or sell securities. It is intended for information only. All opinions are subject to alteration without prior notification. The opinions expressed here may differ to opinions expressed in other documents published by Picard Angst Ltd. including research publications. Neither the document as a whole nor individual parts of it may be reused or distributed to other parties. Although Picard Angst Ltd. is of the opinion that the information contained in this document is based on reliable sources, Picard Angst Ltd. can accept no liability for the quality, accuracy, current relevance or completeness of this information.

© Picard Angst Ltd.

Regulated by the Swiss Financial Market Supervisory Authority (FINMA).