Active managed certificate

‘AI and ESG are the keys to new, attractive AMC solutions.’

‘Two new proprietary certificates, our new issuer platform in Luxembourg and our AI-based approach offer an outstanding framework for the swift expansion of our AMC solutions business.’ Daniel Gerber, Head of Business Development

Daniel Gerber, our expert for actively managed certificate solutions, explains in this interview how Picard Angst uses artificial intelligence to execute bespoke investment strategies quickly, at low cost, and with highly attractive risk/return profiles. In addition, he presents two attractive, new proprietary certificates and shows how you, as a customer, can benefit from our edge in terms of technology and methodologies.

Demand for AMC solutions has seen strong growth over the last few months. How do you go about developing these strategies at Picard Angst?

We pursue an array of approaches. We launch our own investment strategies based on our extensive experience in asset management. Alongside traditional country-based strategies, we also develop solutions based on focus topics and megatrends. Over the past few years, we have invested a sizeable amount of time and resources into digitisation and technology-supported asset management. We have used artificial intelligence to identify a basket of 7,000 stocks that meet our capitalisation, liquidity and ESG criteria from a universe of more than 30,000. Then, we use this basket to systematically construct new strategies, using our proprietary algorithms.

Alongside our previous collaboration with banks and Gentwo on Guernsey, we now have the option of issuing the products ourselves with Picard Angst Securities Sàrl in Luxembourg. This has the benefit of eliminating the counterparty risk, thanks to individual compartments, thereby offering a substantially cheaper alternative to investment funds. With Picard Angst Securities Sàrl in Luxembourg, we also offer a solution that can securitise a pool of assets in a product with an ISIN number, in the field of alternative investments.

For investors, external asset managers, pension funds or banks alike, we offer a full-service option for individual active certificates to execute their investment strategies. Our AMC solution enables investment strategies to be put into practice much quicker and more cheaply than with funds. As a customer, you can concentrate on your strategy, while we handle everything related to executing it. As part of this, our customers can benefit from our edge in terms of research, analytics and risk management, based on artificial intelligence and ESG expertise.

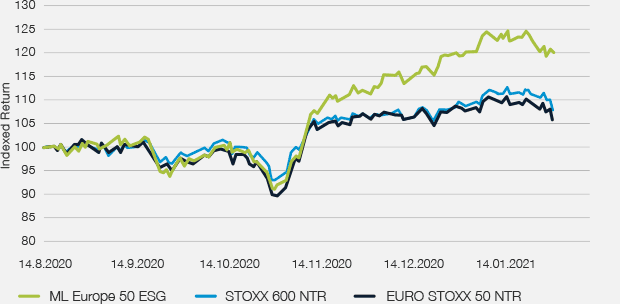

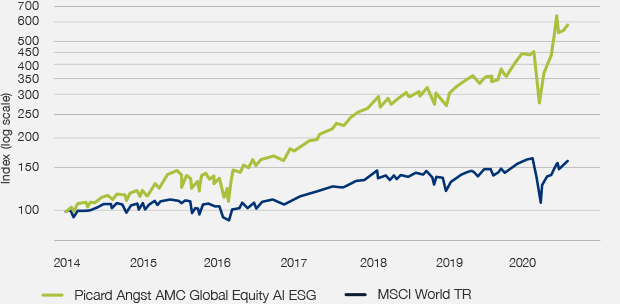

Picard Angst AMC solution beats the benchmark by a wide margin

Picard Angst will shortly be launching its new AMC Global Equity AI ESG. How does this strategy work?

The investment strategy is very simple and easy to understand. Picard Angst AMC Global Equity AI ESG invests in a basket of global stocks. With the help of artificial intelligence, we select the 100 most attractive stocks and give them an equal weighting, taking into account the country and sector weightings of the benchmark, the MSCI World TR. Around 15 percent of the stocks with the worst ESG ratings are excluded from the universe of stocks we can invest in, which hugely reduces the portfolio’s ESG risk. We undertake regular rebalancing to ensure we are fully exploiting the alpha potential. Our AMC offers a very appealing investment solution based on global stocks for investors looking for an active, transparent, risk-optimised strategy that is nevertheless easy to explain.

What are the benefits of this strategy over comparable solutions from other providers?

Nowadays, customers are either looking for low-cost passive index strategies or active strategies that generate alpha sustainably. This product is an actively managed strategy, but its management fee of 0.3% per annum is very attractive, compared to other products. If we generate added value for the customer, thereby beating the benchmark, 85% of the alpha that is generated belongs to the customer. This is very fair.

The unique aspect of our solution is its pairing of a systematic stock strategy with support from artificial intelligence, the fact it takes ESG criteria into account, the equal weighting of the 100 stocks in the portfolio and its risk optimisation, thanks to its country and sector weighting in line with the MSCI World TR benchmark.

All told, customers can enjoy a low-cost, global portfolio featuring the top 100 most attractive stocks.

New Picard Angst AMC Global Equity AI ESG

How exactly does Picard Angst use artificial intelligence when developing AMC solutions?

Picking the right stocks from a universe of 7,000 is a major challenge. Picard Angst has years of experience in handling systematic equity strategies. Thanks to the support of artificial intelligence, we can now process and evaluate the relevant information from huge amounts of data, or big data, as it’s known, much easier and in a much more targeted way.

Thanks to machine learning, an artificial intelligence technique, we can recognise patterns in data strings and, using huge amounts of cloud computing power, identify inefficiencies that were previously hidden.

Our approach is comparable to modern meteorology. Today, enormous quantities of data are analysed for weather forecasts so that the predictions will be more reliable. We want to use this for our own strategies, and also for developing strategies for third parties, too.

As a member of the PRI initiative for responsible investment, Picard Angst integrates ESG considerations into investment decisions. How do you handle this in terms of actively managed certificates?

We integrate ESG criteria when we are putting together portfolios, using our proprietary ESG methodology. On the one hand, this is based on a negative screening with the following exclusion criteria:

- Categorial exclusion of titles active in the development, production, storage and sale of cluster munition, anti-personnel landmines and nuclear weapons, and thereby are in violation of international conventions

- Exclusion of titles on the exclusion list for the Swiss Association for Responsible Investments SVVK ASIR

- Exclusion of the worst ESG ratings on the basis of Picard Angst’s ESG score

And on the other hand, it is based on the approach we have developed to reduce ESG risks through the integrated consideration of ESG scores when constructing the portfolio.

At present, we are developing new solutions to investigate how our portfolio can leave a smaller carbon footprint.

What investors do you recommend an ESG-optimised AMC solution to?

In principle, an ESG-optimised strategy is suitable for every investor. Thanks to our systematic, quantitative methodologies, we are able to draw up bespoke solutions for our investors.

We’ve developed a special solution for pension funds that invest passively. Their goal is to optimise the ESG score of the entire portfolio while simultaneously ensuring a controlled tracking error compared to the underlying strategy or benchmark. For example, our optimisation process enables Swiss stocks with a low tracking error of 0.4% to the index to generate an ESG score that’s around 30% higher.

What is Picard Angst focusing on in terms of developing its AMC solutions further?

In the medium-term, we want to become Switzerland’s leading provider of AMCs, as a sparring partner and full-service provider with top-class service and attractive cost structures. We will launch further in-house AMC solutions on an ongoing basis, both relating to megatrends and other topics. We will also continually expand our digital platform and automate the process of onboarding. Our customers can opt for their own strategies, and we should support them with that.

Legal

- SPV Luxembourg, SPV Guernsey or via an investment bank

Sustainability

- ESG scoring, CO2 reduction, execution of voting rights

Investment/portfolio management

- Our stock database and artificial intelligence provide ideas and support in terms of risk management

Profile

Daniel Gerber has 15 years of experience in Switzerland’s financial sector. He started his career in Corporate Banking at Credit Suisse. As a manager of the investment foundation at Swisscanto, he was then responsible for expanding customer relations, among other tasks. After this, he was responsible for Business Development at ZKB before moving into a managerial role at the fund management company Swiss Rock Asset Management. At Picard Angst, he is responsible for the development of AMC solutions, ESG and additional investment solutions in his role as Head of Business Development.

Picard Angst’s AMC solutions

An actively managed certificate, or AMC, enables investment ideas to be made a reality quickly and easily. AMCs reduce time-to-market and costs to a fraction of what they would be for a fund. With Picard Angst, you can also benefit from a modular approach to this solution: you choose where you need support, or take up our full-service package. In the fields of construction, set-up, management and sales, you can benefit from our advanced digital platform and our AI-based tools.

More about our AMC products

Your contact

Daniel Gerber

Head of Market Switzerland & Chief Sustainability Officer

+

This content is for information purposes only and should not be construed as an investment recommendation, investment advice or the result of any financial analysis, nor should it be construed as an offer or invitation to submit an offer. The "Guidelines for Ensuring the Independence of Financial Research" of the Swiss Bankers Association do not apply to this publication. This document does not constitute a simplified prospectus pursuant to Art. 5 CISA, an offering prospectus pursuant to Art. 652a or Art. 1156 CO or a listing notice within the meaning of the Listing Rules. Therefore, only the simplified prospectus drawn up by the issuer is authoritative, together with all additional product information of the issuer. The simplified prospectus and the additional product information of the issuer as well as the brochure "Special Risks in Securities Trading" may be obtained free of charge at any time from Picard Angst AG, CH-8808 Pfäffikon SZ (Tel. +41 (0)55 290 55 55* or e-mail info@picardangst.com).

From a legal point of view, structured products are debt securities (receivables), so that the default risk depends on the creditworthiness of the issuer. In this respect, the investor bears the risk of a deterioration in the creditworthiness or insolvency of the issuer, which can lead to a partial or total loss of the invested capital.

For a detailed description of all material risks (issuer risk, market risk, currency risk, liquidity risk, product-specific risks, etc.), please refer explicitly to the simplified prospectus of the issuer, together with all additional product information of the issuer. The information contained herein does not replace the qualified advice absolutely necessary prior to any purchase or investment decision, in particular with regard to all associated risks and the suitability of this product.

This publication and the financial product depicted therein are not intended for persons subject to a jurisdiction that restricts or prohibits the distribution of this financial product or of this publication or the information contained therein.

Performance achieved in the past must never be understood as an indication or guarantee of future performance. All information is provided without guarantee.

Calls to the number marked with (*) may be recorded. If you call this number, we assume that you agree to this business practice.