Sustainable investing

Picard Angst launches the "ESG Competence Center"

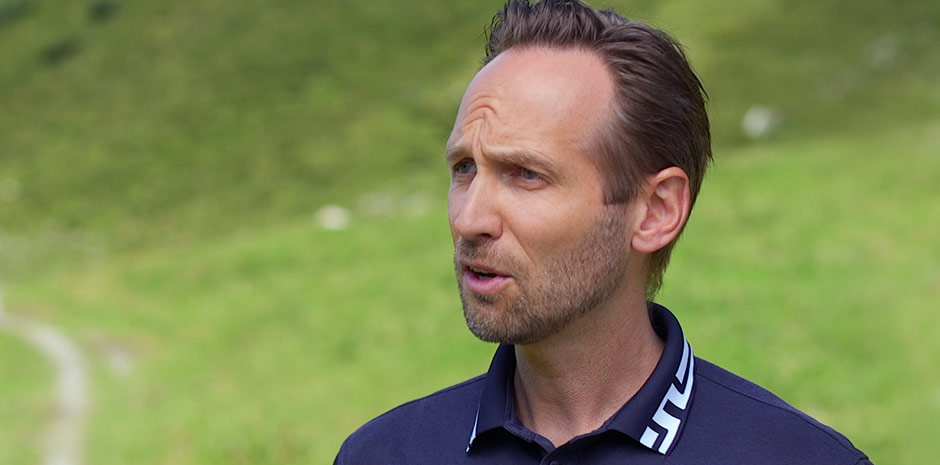

"With the launch of our "ESG Competence Center", we hope to play a leading role among independent asset managers in the field of ESG." Daniel Gerber, Head of Business Development

The Picard Angst "ESG Competence Center" further expands the offering of ESG investment solutions and services for institutional investors, EAMs, family offices and smaller banks. The national strategies are being supplemented with themed impact investing solutions in the form of funds, actively managed certificates and bonds. We also support our clients with data science and tailored ESG solutions – from the strategy to the takeover of the ESG office.

In the Global Risk Report drawn up by the World Economic Forum in 2020, environmental and climate risks occupied the first five places for the first time ever. In 2021, problems caused by infectious diseases are still among the greatest risks facing the world.

The world is reacting to this. The Paris Agreement signed by 196 parties at the United Nations Climate Change Conference sets out the aim to limit global warming to less than two degrees above pre-industrial levels. Over the next few years, the EU will invest 1.8 billion euros into the Green Deal with the aim of achieving climate neutrality by 2050. Similar efforts are also being made in the US and other major economies.

There is a great deal of change happening on a regulatory level. With the Sustainable Finance Disclosure Regulation, the EU has since March 2021 required companies in the finance sector to provide a comprehensive sustainability report, and this will be further expanded next year.

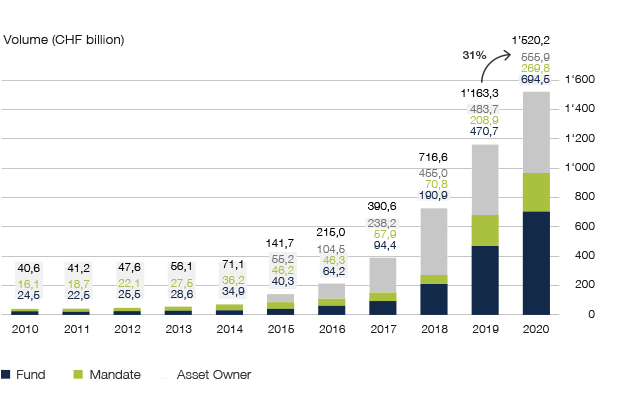

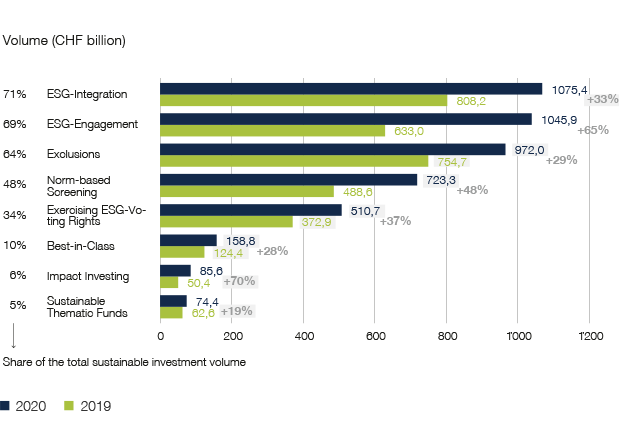

It therefore does not come as much of a surprise that the volumes for sustainable investments in Switzerland alone rose by 30% to CHF 1520 billion in 2020. Standing at CHF 694 billion, the volumes invested in sustainable funds exceeded those invested in conventional funds for the first time ever. The sustainable investments reported by asset owners represent approximately one-third of all of the assets managed by Swiss pension funds and insurance companies.

Strong growth in sustainable investing

Impact investing is becoming increasingly important

In the medium and long term, companies with good ESG ratings will be more commercially successful than competitors that have struggled with the sustainable transformation or do not have sufficient corporate governance. Investors are increasingly avoiding companies with high ESG risks.

A holistic investment approach that takes into consideration environmental, social and corporate governance factors in addition to purely economic aspects can result in better investment results. We believe that ESG criteria are an additional relevant source of information and part of the risk management system for helping to identify and utilise investment opportunities and reduce investment risks. By utilising the ESG criteria, we are increasing the probability of achieving investment goals.

The Picard Angst "ESG Competence Center" has developed its own ESG methodology based on the integrative approach of considering ESG data from a wide range of external providers and label organisations. With the Picard Angst ESG Layer, we have an effective tool to hand for incorporating ESG aspects into investment decisions. This is modular in structure, thus enabling the various client requirements and investment goals to be met. We take into consideration both the minimum standards that have to be adhered to and also the ESG optimisation procedure for maximising sustainability aspects. This means, for example, that companies that are on exclusion lists, such as that of the Swiss Association for Responsible Investments or operate in controversial areas are excluded.

Picard Angst ESG services

Thanks to our longstanding experience in data science and the support provided by artificial intelligence, we are able to handle large amounts of information and data. The centrepiece is our equity database in which we have access to relevant fundamental and ESG data on more than 7’000 equities. From this universe, we can compile, monitor and optimise individual portfolios and strategies.

Institutional clients and partners can benefit from this expertise – not just in the form of investment solutions, but also within the framework of mandates. We provide you with support in terms of the analysis and integration of ESG criteria as well as with respect to active monitoring and reporting. We offer the ESG optimisation of existing portfolios and the building of new portfolios with an individual ESG overlay.

Picard Angst ESG solutions

Discover our new ESG investment solutions and which of the 17 UN Sustainable Development Goals (SDG) these impact now.

The Food Revolution

Invest in the sustainable future of our food.

Find out more

MedTech Venture Capital Fund

Generate an impact for patients and your portfolio.

Find out more

Green Bond Logistics

Generate an impact with sustainable logistics in the Netherlands.

Find out more

Launch of the "ESG Competence Center"

I would like to be regularly informed about the Picard Angst ESG developments.

All fields marked with * are required.

Your contact

Daniel Gerber

Head of Market Switzerland & Chief Sustainability Officer

+

This content is for information purposes only and should not be construed as an investment recommendation, investment advice or the result of any financial analysis, nor should it be construed as an offer or invitation to submit an offer. The "Guidelines for Ensuring the Independence of Financial Research" of the Swiss Bankers Association do not apply to this publication. This document does not constitute a simplified prospectus pursuant to Art. 5 CISA, an offering prospectus pursuant to Art. 652a or Art. 1156 CO or a listing notice within the meaning of the Listing Rules. Therefore, only the simplified prospectus drawn up by the issuer is authoritative, together with all additional product information of the issuer. The simplified prospectus and the additional product information of the issuer as well as the brochure "Special Risks in Securities Trading" may be obtained free of charge at any time from Picard Angst AG, CH-8808 Pfäffikon SZ (Tel. +41 (0)55 290 55 55* or e-mail info@picardangst.com)

From a legal point of view, structured products are debt securities (receivables), so that the default risk depends on the creditworthiness of the issuer. In this respect, the investor bears the risk of a deterioration in the creditworthiness or insolvency of the issuer, which can lead to a partial or total loss of the invested capital

For a detailed description of all material risks (issuer risk, market risk, currency risk, liquidity risk, product-specific risks, etc.), please refer explicitly to the simplified prospectus of the issuer, together with all additional product information of the issuer. The information contained herein does not replace the qualified advice absolutely necessary prior to any purchase or investment decision, in particular with regard to all associated risks and the suitability of this product

This publication and the financial product depicted therein are not intended for persons subject to a jurisdiction that restricts or prohibits the distribution of this financial product or of this publication or the information contained therein.

Performance achieved in the past must never be understood as an indication or guarantee of future performance. All information is provided without guarantee

Calls to the number marked with (*) may be recorded. If you call this number, we assume that you agree to this business practice.