Energy transition –

a driver for commodity investments

The energy transition is gathering pace. The massive structural shift from fossil fuels to metals offers excellent opportunities for investors. For more than 20 years, we have helped institutional investors outperform established benchmarks through systematic commodity investing. Benefit from our expertise now, while the momentum is favourable.

360° Commodity Expertise

Why

commodities?

growth

protection

Why choose

Picard Angst?

Center

Why

customised?

Products

«Our commodity strategies have delivered solid outperformance against established benchmarks for almost 20 years.»

Dr. David-Michael Lincke, Head of Asset & Portfolio Management

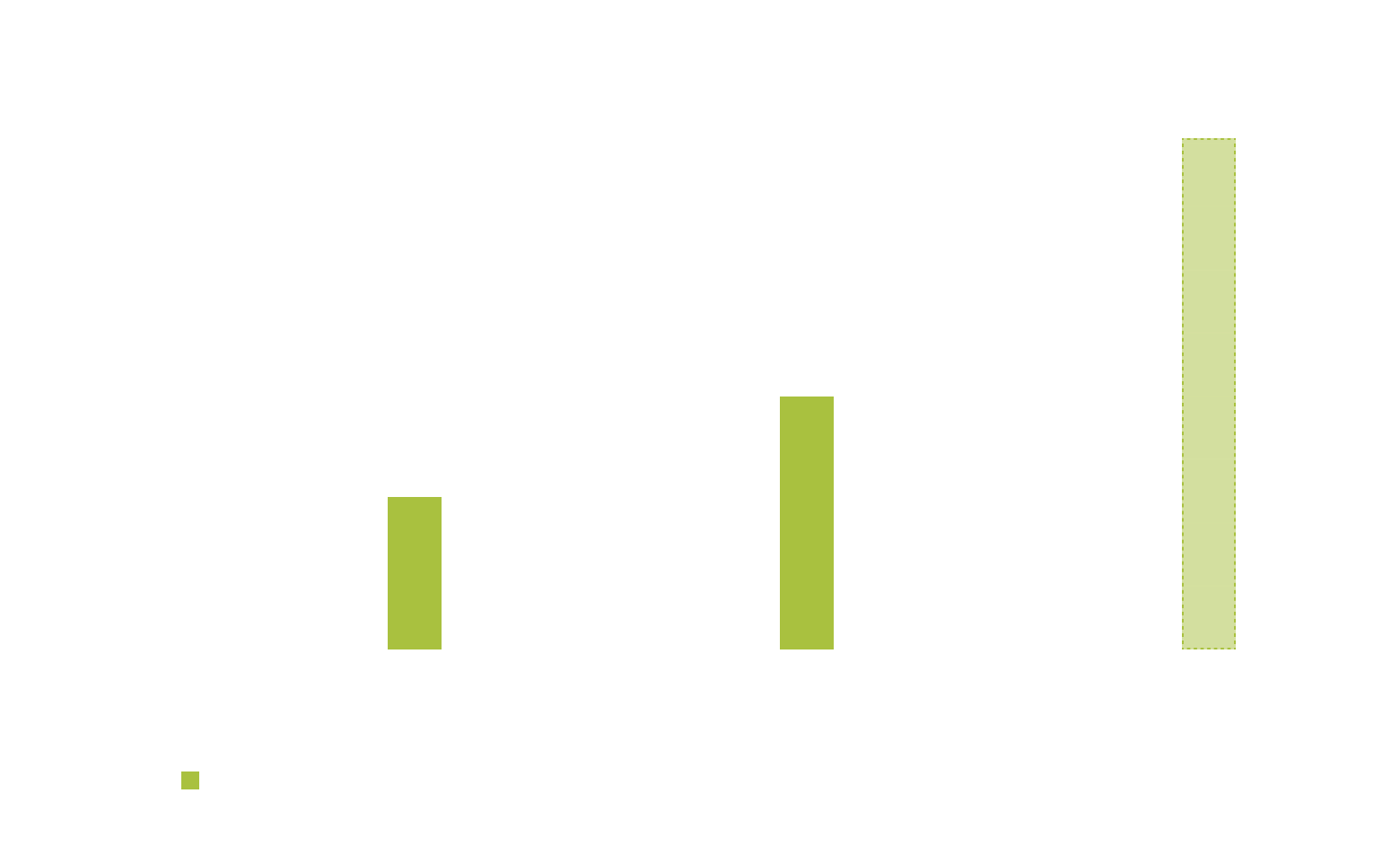

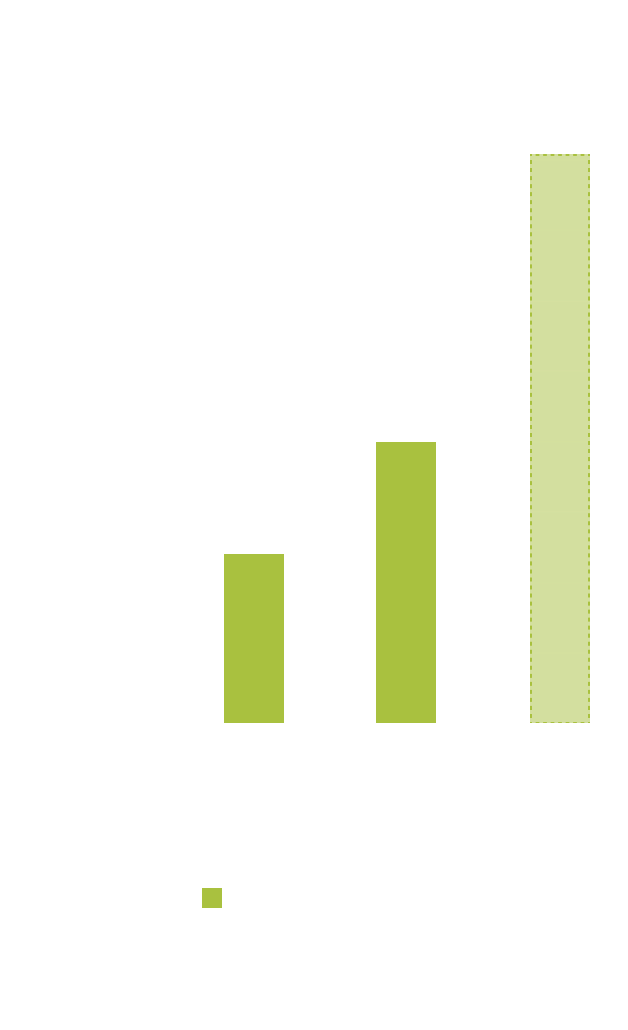

The energy transition is gaining momentum

In 2024, global investment in clean energy will surpass fossil fuel investments by reaching twice their amount for the first time. However, to achieve climate targets, this investment must double again by 2030 compared to current levels.

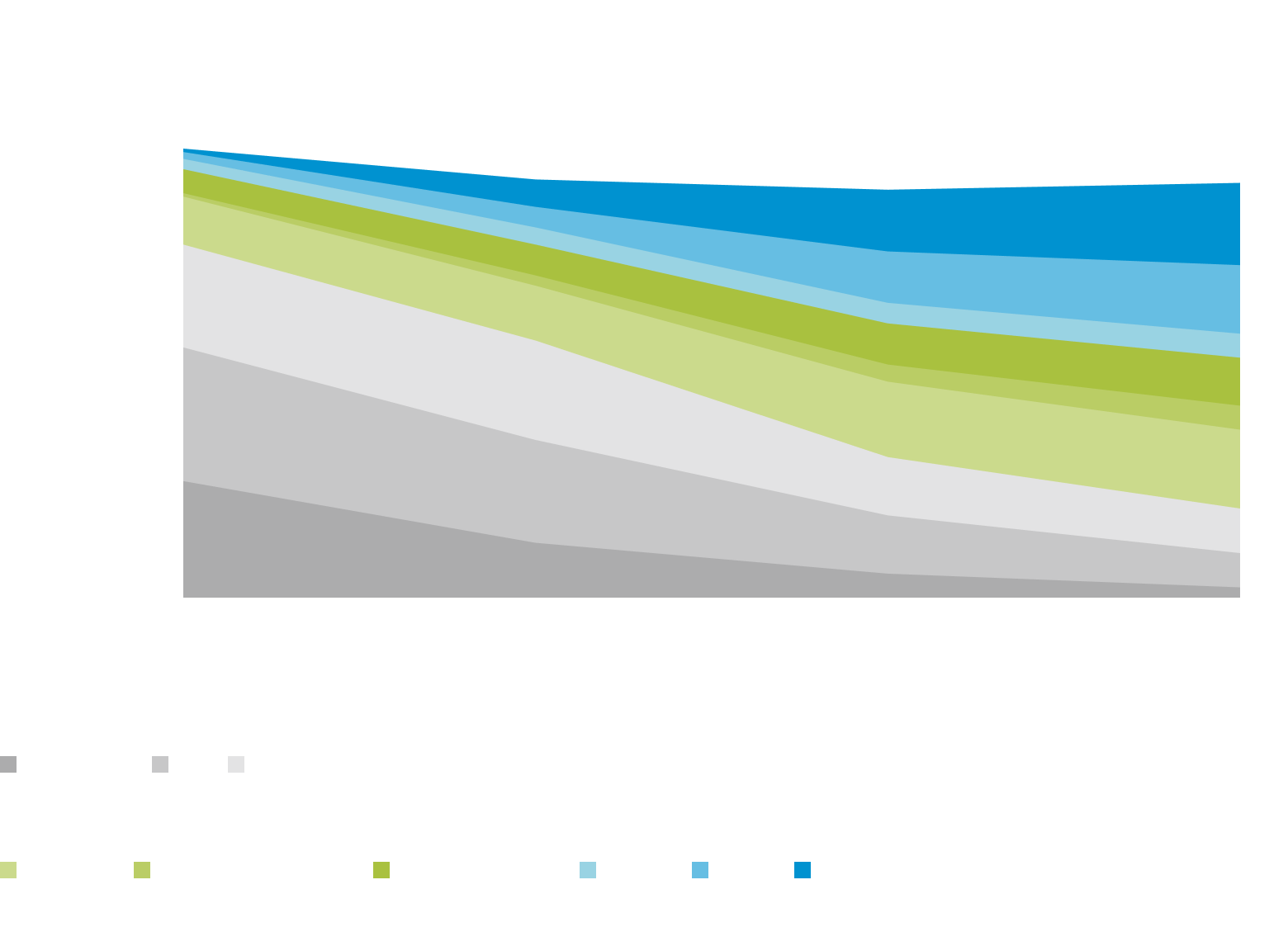

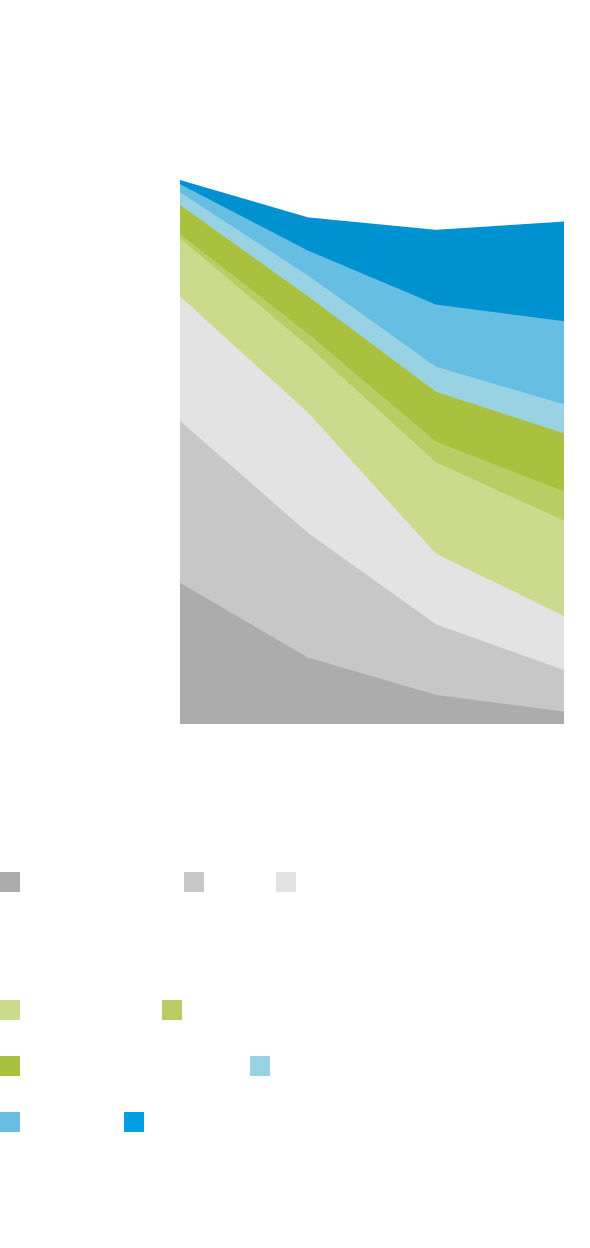

Net zero turns the energy mix upside down

Decarbonization efforts to meet climate change targets are driving a dramatic shift in the global energy supply, moving away from fossil fuels and towards renewable electricity.

Commodities investment ideas

Our commodity strategies are among the preferred solutions of professional investors in Switzerland. Discover a few of our investment ideas.

Picard Angst All Commodity Tracker Plus

A broadly diversified and systematic commodities investment strategy in a Swiss fund vehicle with a transparent structure. Its favourable risk/return profile makes it an attractive alternative to the relevant commodity benchmarks.

Downloads

- Picard Angst All Commodity Tracker Plus – Institutional USD (ISIN CH0049136804)

- Picard Angst All Commodity Tracker Plus – Institutional CHF hedged (ISIN CH0049136846)

Further asset classes in the download centre or from your contact person. Official publications can be found at www.swissfunddata.ch.

Picard Angst Key Transition Metals AMC

The Picard Angst ESG+ Equity Key Transition Metals Note pursues a strategy that minimises investment and ESG risks compared to other products in the sector. It offers investors diversification through indirect exposure to metals prices, which are typically weakly correlated with the broader equity market. Over the past 5 years, this strategy has delivered significantly higher risk-adjusted returns than relevant benchmarks.

Picard Angst Hydrogen Revolution Basket AMC

The portfolio consists of approximately 20 companies involved in different segments of the hydrogen economy, providing broad diversification. Active management allows for flexible adjustments to market shifts and growth opportunities. This strategy plays a key role in reducing CO2 emissions and advancing renewable energy development.

Your contacts

Daniel Gerber

Head of Market Switzerland & Chief Sustainability Officer

+

Dr. David-Michael Lincke

Head of Asset & Portfolio Management

+

Agnes Rivas

Senior Client Advisor Sustainability

+

Important legal information:

We would like to inform you that telephone calls made to our phone lines are recorded. We assume that you are in agreement with this when you call.

This presentation draft represents a future project from Picard Angst. It is not an offer or invitation to buy or sell securities. It is intended for informational use only. Investments should only be made after the fund documentation in question has been read thoroughly. This presentation does not contain binding information; the offer documentation is the sole legally binding documentation.

The “Directives on the Independence of Financial Research” from the Swiss Bankers Association do not apply to this presentation. We wish to make you aware that it cannot be excluded that Picard Angst AG has a vested interest in the development of the price of individual titles or all the titles listed in this document.

The value and returns of the shares can increase or decrease. They are influenced by market volatility and currency fluctuation. Picard Angst AG accepts no liability for any losses. Past performance of values and returns is no indicator of ongoing and future performance. The performance of values and returns does not take into account any charges and fees incurred upon purchase, redemption and/or exchange of the shares. The allocation by country, currency and individual items, and any benchmarks stated, can change at any time within the framework of the investment policies stated in the legal prospectus.

All statements can be changed without prior notice. Statements can differ from estimates given in other documents published by Picard Angst AG, including research publications. Neither the entire document nor parts thereof may be reused or redistributed. While Picard Angst AG is of the opinion that the information included herein draws on reliable sources, Picard Angst cannot guarantee the quality, accuracy, validity or completeness of the information contained within this document.

If the fund, partial fund or share class is not registered for public offer and sale, the sale of shares can only be undertaken within the framework of private placements, or in the institutional domain, with regard to applicable local laws. The fund may not be sold in the USA nor to US citizens, neither directly nor indirectly.

Picard Angst AG is an asset manager handling collective capital investments pursuant to the Federal Law on Collective Capital Investments and is subject to the oversight of the Swiss Financial Market Supervisory Authority.