AMC on Hydrogen Revolution Basket Hydrogen index with leading technology companies

Equity strategy capturing structural growth across the global hydrogen value chain – from production and storage to infrastructure and applications.

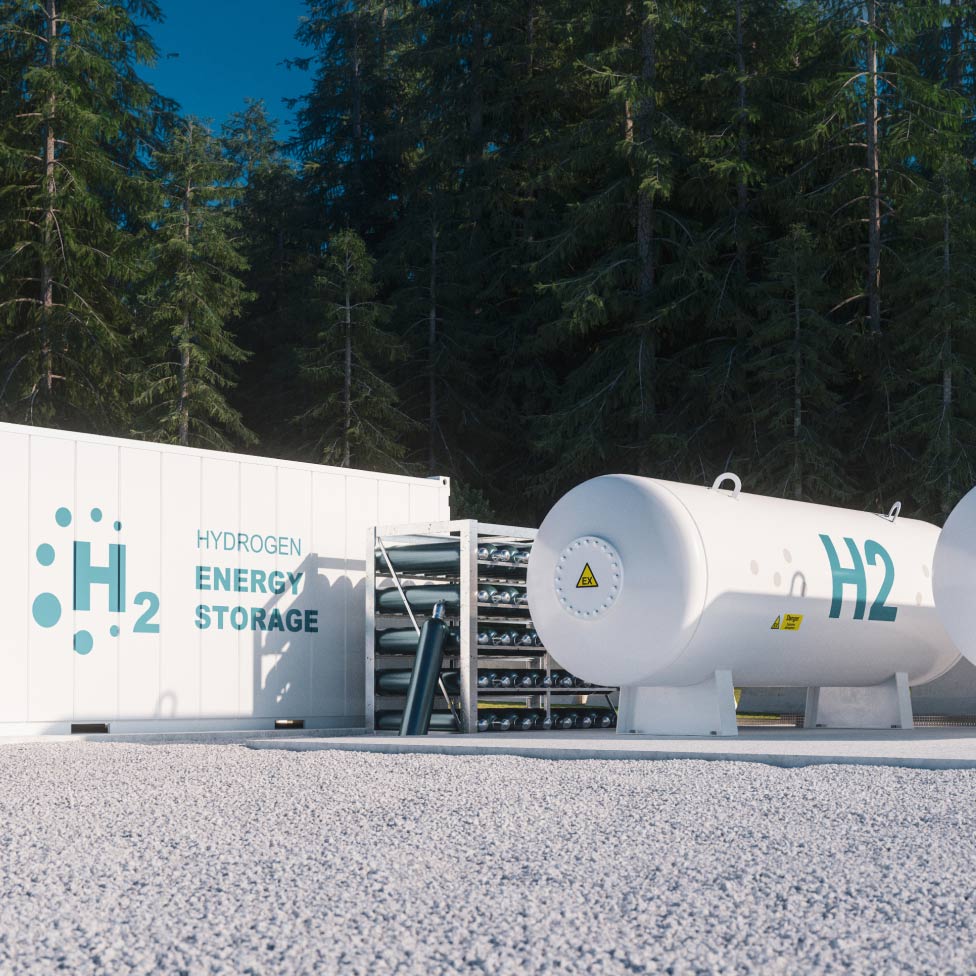

The global energy transition to protect the climate is driving technological development and the transition to renewable energies. Hydrogen, the most abundant element in the universe, is seen as a promising, clean and renewable energy carrier. It can efficiently replace fossil fuels and is used as a fuel for mobility, as energy storage for electricity and gas grids and as a raw material for industry. The growing focus on green hydrogen, which is produced by electrolysis using renewable energy, is supporting global decarbonisation efforts. Governments and companies are increasingly investing in hydrogen technologies to promote sustainable and environmentally friendly energy alternatives.

Underlying:

The underlying of this AMC is the Hydrogen Revolution Basket, which comprises companies active in various segments of the hydrogen value chain. This includes companies that develop and commercialise electrolysers, fuel cells, hydrogen storage technologies and infrastructure as well as applications in the transport and industrial sectors. Examples of such companies are Plug Power, Ballard Power Systems, Nel ASA and the recently added EnerSys. These companies are leaders in their respective fields and contribute significantly to the development and diffusion of hydrogen technologies.

- Growing sector: The hydrogen sector is experiencing continuous growth and increasing demand, as hydrogen is considered a key component of the energy transition.

- Diversification: The basket covers the entire hydrogen value chain and offers broad diversification within the sector.

- Dynamic rebalancing: Through regular rebalancing, the stocks in the basket are adjusted to current market conditions in order to optimise returns.

- Forward-looking companies: The basket contains leading companies in the hydrogen sector that are driving technological innovation and benefiting from the growing demand for hydrogen.

- Broad diversification: The basket comprises around 20 companies that are active in various areas of the hydrogen economy and thus offers comprehensive diversification.

- Dynamic management: The active management of the basket enables flexible adaptation to market changes and growth opportunities.

- Sustainable investment: Investors can invest in a sector that makes a significant contribution to reducing CO2 emissions and promoting renewable energies.

- Long-term potential: The hydrogen sector has great long-term potential as it plays a key role in the global energy transition and decarbonisation.

- Reputable partners: The issuer Luzerner Kantonalbank AG and the asset manager Picard Angst AG ensure professional management and a transparent structure of the product